What Does Emv Mean In Real Estate

When What Does Emv Mean In Real Estate most people think of the terms “emv,” “chip and pin,” or “smart card” they probably think of their banking institution. But what about when it comes to buying and selling real estate? The adoption of EMV has had a big impact on the real estate industry, and it’s something you should be aware of if you’re in the market for a home or property. In this blog post, we will discuss what EMV is, how it works, and some of the benefits it has for buyers and sellers.

What is Emv?

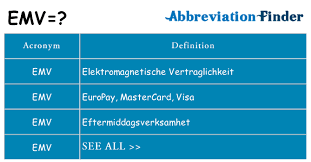

Emv is short for EMVCo, which stands for the Europay, MasterCard and Visa network. This network is responsible for issuing cards that use chip technology, as well as processing payments. When you make a purchase with an EMV card, the cardholder’s bank sends a payment to the merchant. The merchant then confirms the payment and notifies the cardholder’s bank.

The following types of transactions are processed using EMV: in-store purchases, online purchases, recurring billing through mobile apps and contactless payments.

What Does It Mean for Real Estate Markets?

As we move into 2019, many homeowners are beginning to ask themselves if the EMV chip technology will have a significant impact on the real estate market. After all, it has been around for only a few years and many people may not be familiar with its ins and outs. In this article, we’ll take a closer look at what EMV is, how it works, and some possible implications for the real estate market.

What Is EMV?

EMV is short for Europay, Mastercard and Visa. It’s a payment system that was developed in 1992 to allow cardholders in Europe to make payments using their cards without having to enter their PINs. The system uses chips instead of magnetic strips to store account information, which makes it more secure.

How Does EMV Work?

When you make a purchase using your credit or debit card at a merchant who accepts EMV cards, the card issuer (typically your bank) sends out a transaction request to the merchant. The merchant then sends back a response that includes information about the purchase (e.g., item price, number of items purchased). The card issuer then processes the payment by debiting your account and sending a confirmation message back to the merchant.

What Are Some Possible Implications For The Real Estate Market?

There are several potential implications for the real estate market as a result of EMV adoption:

1) Increased Security: As mentioned earlier, one of the main benefits of

How will Emv Affect the Real Estate Industry?

Emv is short for “enhanced magnetic Visa.” The new technology was first approved by the U.S. federal government in 2015 and will soon be implemented in all 50 states. Emv is a chip-and-pin card that uses radio-frequency identification (RFID) to speed up transactions and minimize fraud.

According to the National Credit Union Administration (NCUA), enhanced magnetic Visa could reduce credit card fraud by as much as 44%. This is good news for consumers, as it will make it more difficult for thieves to steal cards and use them at unauthorized locations.

Real estate agents are sure to see some benefits of Emv, too. For one, it will make it easier for buyers and sellers to complete transactions quickly and easily. Agents who accept cards using Emv can also expect increased sales because their clients will be more comfortable using these types of cards.