What Is Capex In Real Estate

If What Is Capex In Real Estate you’ve ever read about real estate investing, you may have come across the term “Capex.” But what is Capex in real estate? How does it affect your investments and what do you need to know about it? In this article, we will explore what Capex is, why it’s important for investors to be aware of it, and how to use it in your next real estate investment. We’ll also cover some tips for getting the most out of your Capex and the potential risks associated with using it. Read on to learn more!

What is Capex?

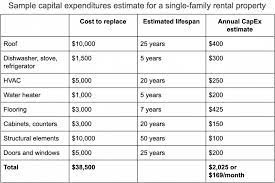

Capex in real estate refers to the money that is spent on capital improvements to a property. This can include anything from major renovations to adding new features or amenities. Capex is different from operating expenses, which are the costs associated with running a property on a day-to-day basis.

When considering whether or not to make a capital improvement to a property, investors will look at the expected return on investment (ROI). If the ROI is high enough, it may be worth taking out a loan or using other funds to finance the project. However, if the ROI is low, it may not be worth the risk and investors will choose to forego the project.

It’s important to keep in mind that capeX expenditures can have a big impact on the value of a property. For example, if an investor spends $100,000 on renovations and the value of the property increases by $150,000 as a result, then their ROI would be 50%. However, if the value of the property only increases by $50,000, then their ROI would drop down to 20%.

As you can see, capeX can be a risky proposition but one that can pay off handsomely if done right. When evaluating whether or not to embark on a capital improvement project, make sure to do your homework and calculate your expected ROI so that you can make an informed decision.

How is Capex used in Real Estate?

Capex, or capital expenditure, is the money a company spends to buy, maintain, or improve its long-term assets. This can include things like buying new real estate, renovating an existing property, or making major repairs.

For real estate investors, understanding how and when to use Capex is critical in order to maximize profits and minimize risk. Here are a few key points to keep in mind:

1. Timing is everything: The timing of your Capex expenditures can have a big impact on your bottom line. For example, if you’re planning to sell a property in the near future, it may not make sense to invest a lot of money into improvements that will increase the value of the property (since you won’t be around to enjoy the increased value). On the other hand, if you’re planning to hold onto a property for the long haul, investing in some upgrades now could pay off down the road.

2. Know your market: It’s also important to understand your local real estate market before making any decisions about Capex. If properties in your area are selling quickly and for top dollar, it may not make sense to spend money on improvements since you probably won’t see a significant return on investment. However, if properties in your area are sitting on the market for months at a time, investing in some upgrades could help you sell faster and for a higher price.

3. Work with a professional: If you’re

Pros and Cons of using Capex

Capex, or capital expenditure, is the money a company spends to buy or improve its fixed assets. This can include things like buildings, machinery, and equipment. It can also include money spent on intangible assets like patents and copyrights. For real estate investors, cape

There are a few key advantages to using capex when investing in real estate. First, it allows you to deduct the expenses from your taxes. This can save you a significant amount of money over time. Second, it can help you acquire property at a lower cost. By improving the property with your own money, you can increase its value and sell it for more in the future. Finally, using capex can help you build equity in your property more quickly.

There are also some drawbacks to using capex when investing in real estate. One is that it requires a significant amount of upfront capital. This can be difficult to obtain if you don’t have a lot of savings or access to loans. Another downside is that it takes time to complete improvements on a property. This means you won’t be able to generate rental income from the property right away. And finally, there’s always the risk that the improvements you make won’t increase the value of the property as much as you hope

What are some alternative ways to finance Real Estate?

There are many different ways to finance your real estate investment. You can take out a loan from a bank, or you can use private financing. You can also use a combination of both.

Bank Loans:

The most common way to finance your real estate investment is through a loan from a bank. Banks will usually require you to put down 20% of the purchase price as a down payment. They will also want to see proof that you have the ability to repay the loan.

Private Financing:

Another option for financing your real estate investment is through private financing. This is when you get a loan from an individual or company, rather than from a bank. Private lenders will often give you more flexible terms than banks, but they will also charge higher interest rates.

Combination Loans:

A third option is to combine both bank loans and private financing. This can give you the best of both worlds – the flexibility of private financing and the lower interest rates of bank loans.

Conclusion

Capital expenditures, or capex for short, are an important part of real estate investing. They can be used to fund repairs and improvements that will enhance the value of your property or help you save money on energy costs in the long run. By understanding what capex is, as well as its various types and factors to consider when making decisions about it, investors can make informed decisions that benefit their investments and ensure they get the most out of their real estate investments.