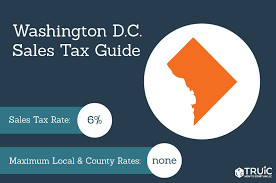

What Is The Sales Tax In Washington Dc

Welcome What Is The Sales Tax In Washington Dc to the bustling capital of the United States, Washington D.C.! Home to iconic landmarks like the White House and Capitol Hill, this city is a hub for both tourists and locals alike. But with all its perks comes certain expenses, including taxes. So what’s the tea on sales tax in this District? Whether you’re planning a shopping spree or just curious about how much extra cash you’ll need to budget, we’ve got you covered with all that you need to know about Sales Tax in Washington DC!

What is the Sales Tax In Washington Dc?

In the District of Columbia, sales tax is currently at 7.75%. This means that the price of a product that is sold in the District of Columbia will have to include this tax. This tax is usually added to the base price of the product.

Some items that are exempt from sales tax in D.C. include food, medicines, and clothing. There are also some items that are subject to a lower rate of sales tax than 7.75%. These include books, tobacco products, and childcare services.

How much sales tax is there in Washington Dc?

There is currently a 6.5% sales tax in Washington D.C. This means that for every $100 you spend at a store, the government takes $6.50 off of your purchase. Keep in mind that this tax applies to both online and in-store purchases, so be sure to add it onto your total when calculating how much you’ll owe.

What are the exemptions from Washington Dc’s Sales Tax?

In Washington D.C., there are a few exemptions from the sales tax. The most common exemption is for food. There is also an exemption for clothing and footwear that costs less than $175 per item. Additionally, there is an exemption for goods that are consumed or used in a business or home-based occupation.

How to calculate the sales tax in Washington Dc

There are three tax rates in Washington D.C.: 7.75%, 11.85%, and 15%. All prices must include the applicable sales tax unless a specific exemption applies. You can find the sales tax rate on purchases made at participating stores or by using a retail calculator such as this one.

To calculate the sales tax due on a purchase, first find out the price of the item without sales tax. This will be your base price. Then add the applicable sales tax to get your total purchase price with sales tax. To calculate the taxes payable, subtract your total base price from your total purchase price with sales tax to get your taxable amount.

What to do if you didn’t pay the correct amount of sales tax in Washington Dc

If you didn’t pay the correct amount of sales tax in Washington Dc, you may be able to get a refund. The sales tax rate in the District of Columbia is 7%. If you paid less than the required amount, you can file an online claim with the DC Tax Department. To file a claim, visit dctax.dc.gov and click on “File a Claim.” Complete the form and submit it with your proof of purchase. You will need to include your name, address, phone number, date of purchase, and proof of tax payment.