How To Calculate Roi On Real Estate

Roi How To Calculate Roi On Real Estate (return on investment) is a metric that businesses use to measure the effectiveness of their marketing campaigns. Roi can be used to gauge the return on investment (ROI) for any type of marketing—from digital ads to in-person outreach. While there are many different ways to calculate Roi, we’ve provided a simple example here that will help you understand how it works.

What is Roi?

Roi, or Return on Investment, is a calculation used in business to measure the profitability of an investment. Roi is calculated as the percentage of increase in shareholder value over a period of time. It can be used to compare different investments and decide which one generates the highest return.

In real estate, Roi can be used to evaluate different investments, including purchases, leases, and developments. When calculating Roi for acquisitions or redevelopments, it is important to consider both the net present value (NPV) and internal rate of return (IRR). NPV measures how much money would be available at the end of the project if all cashflows were discounted back to their present value. IRR measures how much money an investment produces each year relative to its initial cost.

When evaluating properties for lease, it is important to consider both Rent Multipliers and Net Operating Income (NOI). The Rent Multiplier calculates how much more rent an owner will receive compared to what they would have received if the property were leased at market rates. NOI measures a property’s income after expenses are paid, including maintenance costs and depreciation.

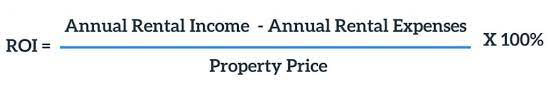

How to Calculate Roi

There are a few ways to calculate the return on investment ( Roi) for real estate. The most common calculation is net operating income (NOI). NOI measures the total revenue generated by a property after all expenses are paid, including depreciation and amortization.

One popular measure of ROI is the internal rate of return (IRR). IRR takes into account both the initial investment and how much cash flow is generated over time. It’s a good indicator of whether a property is making money or not.

You can also calculate ROI based on rental income, price appreciation, or total value. However, each method has its own benefits and drawbacks. Ultimately, you’ll need to decide which one works best for your situation.

Roi calculator for real estate

Are you thinking about starting a Real Estate business? Or are you already in the business and want to know how well you’re doing? Roi, or return on investment, is a great way to measure your business success.

Roi is calculated as the percentage of increase over cost of goods sold (COGS). In other words, Roi tells you how much more money your company made, relative to the amount of money it cost to operate.

There are a few factors that affect Roi:

-The quality of your product/service

-Your marketing strategy

-Your operating costs

Conclusion

In this article, we will outline the steps involved in calculating return on investment (ROI) for a property. By following these simple steps, you can determine exactly how much your property is worth and whether or not it represents an optimal investment for you. Remember to keep in mind all of the factors involved when making such a decision – location, size, condition – and use our tips to help you optimize your ROI. Thanks for reading!