Learn More about home improvement loan calculator

Sometimes, home improvement loan calculator all you need is a little help in order to renovate or improve your home. However, with so many choices available, it can be hard to know which one is right for you. That’s where the home improvement loan calculator comes in. This handy tool can help you figure out what you need in order to make your dream home a reality. Simply enter in some basic information about your property and the type of renovation or improvement you’re looking to do, and the calculator will give you an estimate of the cost. If you’re unsure about whether or not a renovation is the right move for you, using a home improvement loan calculator can help make sure your finances are taken care of while you make your dream home a reality.

What is a home improvement loan calculator?

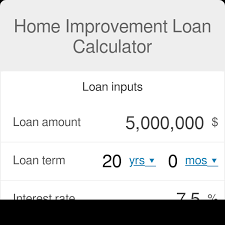

The home improvement loan calculator can help you determine the amount of money you need to borrow in order to buy the items you desire, such as new paint, a new flooring system or a new roof. The home improvement loan calculator also allows you to see how much interest and principal you will pay over the life of the loan.

How a home improvement loan calculator works

A is a great tool to use when trying to figure out how much money you will need for a home improvement project. This calculator takes into account the cost of materials, labor and other associated costs. You can also use this calculator to see if you are eligible for a particular loan program.

Different types of home improvement loans

When you are ready to start your home improvement project, it’s important to choose the right type of home improvement loan. There are many different types of loans available, and it can be hard to decide which one is best for you. Here are some different types of home improvement loans:

Traditional Home Improvement Loans

Traditional home improvement loans are usually used for larger projects, like renovating your entire home. These loans come with interest rates that can be quite high, so make sure you compare them carefully before choosing one. Some lenders also offer flexible payment options so that you can afford your project without having to worry about huge payments each month.

Home Equity Lines of Credit (HELOCs)

If you only need a small amount of money to finance your home improvement project, an HELOC may be a good option for you. With an HELOC, you borrow a fixed amount of money from the bank and then use that money to buy things like flooring or tools necessary for your project. repayment on an HELOC is usually done over a set period of time, usually 9-25 years. Interest rates on HELOCs tend to be lower than traditional home improvement loans, but they do have one big downside: if you don’t repay the loan in full when the term is up, the bank can take back your house – even if you’ve already invested a lot of money in it!

payday Loans

A payday loan is exactly

How to use a home improvement loan calculator

There are a few things you need to keep in mind when using a . The first is that the amount of the loan will be based on your specific needs and the amount of money you are borrowing. You also need to consider your credit score, the interest rate, and how long the loan will be for.

Once you have those details figured out, you can use a to get an estimate of what you may need to borrow. There are a lot of different calculators out there so it can be tough to decide which one to use. If you are looking for a general overview, check out websites like MoneyTips or WalletHub. They have comprehensive reviews of different types of calculators as well as guides on how to use them. Before using any type of calculator, make sure that you read the terms and conditions that come with it so that you know what is expected from you in terms of repayments.

Conclusion

Thank you for reading our article on the . In it, we reviewed the different types of home improvement loans and explained how they work. We also included a calculator that will help you figure out your approximate borrowing amount. If you are interested in getting a home improvement loan, our article should have helped you understand all of the options available to you and narrowed down which one is best for your specific needs. Thank you for reading!