When The Fed Conducts Open Market Sales

If When The Fed Conducts Open Market Sales you’re curious about how the Federal Reserve influences the economy, then buckle up because we are delving into a crucial aspect of their monetary policy: open market sales. We’ve all heard that the Fed buys and sells securities to control inflation rates, but what exactly does this mean? How do these actions impact our everyday lives? In this blog post, we’ll explore everything you need to know about open market sales and how they affect the overall health of our economy. So grab your coffee and let’s dive in!

What is an Open Market Sale?

When the Federal Reserve conducts open market sales, it encourages borrowing and spending by selling securities to the public. This helps to stimulate the economy by increasing demand for goods and services. The Fed also sells securities in order to reduce the amount of outstanding debt.

How Does the Fed Conduct an Open Market Sale?

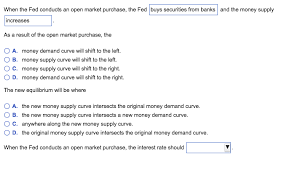

The Federal Reserve System conducts open market sales of Treasury securities in order to increase the money supply and lower interest rates. The Fed announces the date, time, and amount of the sale a few days in advance. After the sale, the securities are sold to investors on exchanges or through brokerages.

The goal of an open market sale is to increase the quantity of money available to purchase goods and services. The Fed sells securities to achieve two goals: first, it wants to reduce interest rates so that people have more money to borrow and spend; second, it wants to increase the overall supply of financial assets so that prices for those assets will fall (and encourage businesses and consumers to borrow more).

In order to make sure that buyers and sellers are matched appropriately, the Fed uses a system called auctions. Auctions are similar to stock markets where investors bid on securities with the hope of getting a higher price than others. The process begins with the Fed announcing how many securities it plans to sell (known as its offering). Then, banks and other dealers submit bids for these securities. The lowest bidder gets the security, but may have to pay a commission.

Open market sales can also be used as a way for the Fed to buy Treasury securities from banks. This occurs when banks need cash quickly and decide not to sell their Treasury holdings directly to the Fed. The Fed then buys these securities from banks at a discount (meaning it pays less than what they’re worth

Why Does the Fed Conduct Open Market Sales?

The Federal Reserve conducts open market sales (OMS) to manage interest rates and provide liquidity in the financial system. Open market operations are also used to support the economy and meet mandated reserve requirements. The Fed sells securities to institutions that hold them as assets, such as banks, insurance companies, and pension funds. OMS provides an important source of financing for businesses and consumers.

The Fed sets the target range When The Fed Conducts Open Market Sales for the federal funds rate by determining how much liquidity it wants to promote in the financial system while still meeting its reserve requirement. The Fed will sell securities if the federal funds rate is below the target range or buy securities if the federal funds rate is above the target range. By influencing short-term interest rates, OMS affects borrowing costs and economic activity.

Conclusion

The Federal Reserve conducted open market sales yesterday in order to keep interest rates low. Open market sales are when the Fed s When The Fed Conducts Open Market Sales ells government bonds to investors on the open market. The purpose of these sales is to increase liquidity and make it easier for businesses and consumers to borrow money. By selling these bonds, the Fed decreases demand for those bonds, which will in turn decrease the interest rate that companies have to pay on their loans.