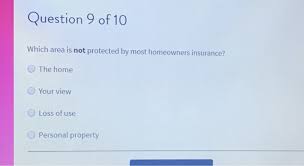

Which Area Is Not Protected By Most Homeowners Insurance?

When Which Area Is Not Protected By Most Homeowners Insurance? you think of homeowners insurance, you might think of things like theft and fire. But what about other risks? What if your home is not protected by most homeowners insurance policies? In this blog post, we will explore the different types of risks that are not usually covered by most homeowners insurance policies. From floods to avalanches, you’ll learn about some of the more unusual risks that can impact your home. If you want to make sure your family is protected in case of an emergency, be sure to read this blog post and take action accordingly.

What Are The Different Types of Homeowners Insurance?

Homeowners insurance protects the owner and their belongings in the event of a claim. There are three types of homeowners insurance: personal property, dwelling, and liability.

Personal property insurance covers things like furniture, electronics, and other small items. Dwelling insurance covers the structure of your home, including materials and fixtures inside. Liability insurance covers you for any legal expenses that may come from an incident at your home.

Which Areas Are Not Protected By Most Homeowners Insurance?

Many people do not realize that certain areas in their home are not protected by most homeowners insurance policies. These areas may include the roof, windows and doors, and eaves. Each of these areas has different risks associated with them, so it is important to know which ones are not covered by your policy if you want to protect yourself financially.

How Can I Find Out If My Home is Protected By Most Homeowners Insurance?

Homeowners insurance policies vary significantly by state, so it can be hard to know which areas are not covered by your policy. The National Association of Insurers (NAI) provides a map that shows which areas are not typically covered by homeowners insurance. Areas that tend to be excluded from coverage include the following:

-Wetlands

-Pools and spas

-Deck, porch and railing

-Mobile homes

Conclusion

If you’ve been considering renter’s insurance but aren’t sure where to start, read on for some helpful advice. For starters, homeowners insurance typically doesn’t cover damage caused by wind or water – two common causes of property damage in renters’ lives. Furthermore, not all items in a home are covered by homeowners insurance. This includes things like antiques and artwork, as well as custom built features like porches and decks. Finally, renters may be at a disadvantage when negotiating with their landlords because they usually don’t have the same level of ownership rights that homeowners do. If you’re planning to live in your home for an extended period of time or if your landlord is difficult to deal with, it might be worth investing in renter’s insurance.